Evaluation of FOREX trading Strategies based in Random Forest and Support Vector Machines

Keywords:

Financial Machine Learning, FOREX, Random Forest, SVM, Performance of Technical Trading RulesAbstract

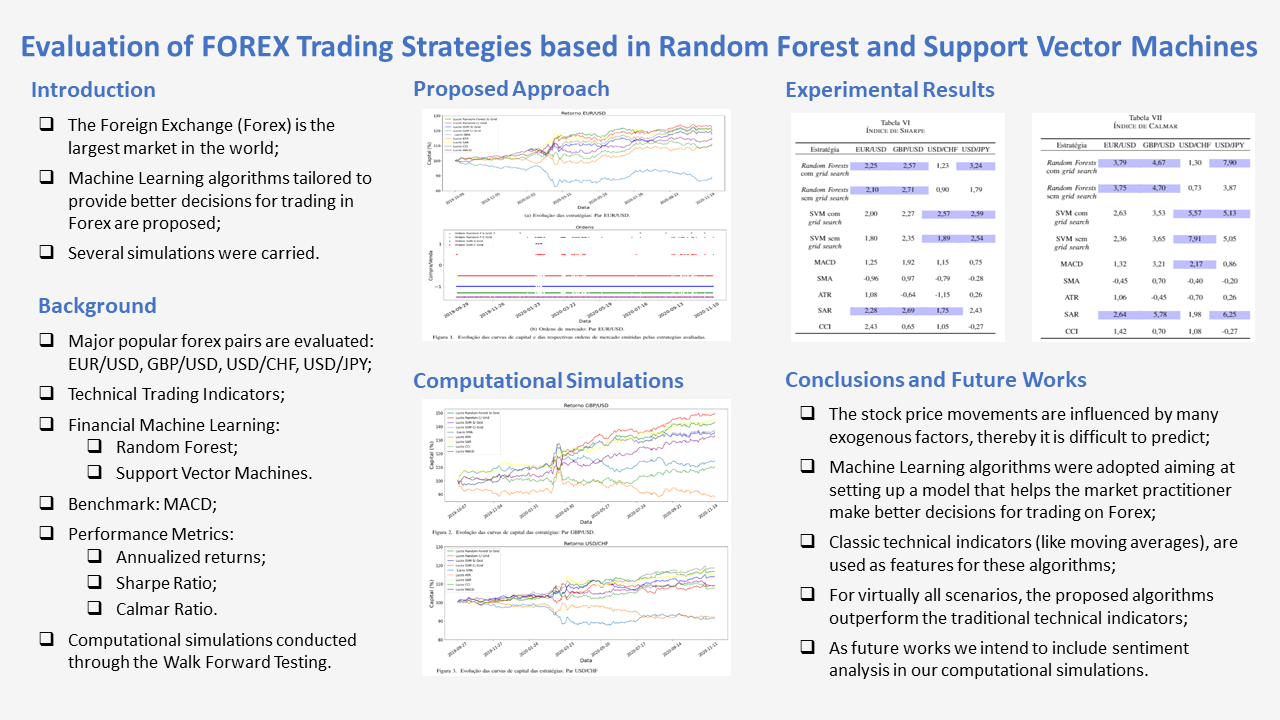

The Foreign Exchange (Forex) is the largest market in the world and has a daily trading volume of approximately 3.2 trillion dollars. The price movements are influenced by many exogenous factors, thereby it is difficult to predict. As a result, modeling its movement would enable high profitable investment strategies. Aiming at setting up a model that helps the market practitioner make better decisions for trading on Forex, Machine Learning algorithms (Random Forest and SVM) are adopted in this work. Classic technical indicators, like moving averages, are used as features for these algorithms. In order to evaluate these approaches, several simulations were carried out on the pairs Euro/Dollar, Pound/Dollar, Dollar/Swiss Franc and Dollar/Japanese Yen, using three different metrics. For virtually all scenarios investigated, the proposed algorithms outperform the traditional technical indicators.

Downloads

References

R. W. Colby, The Encyclopedia of Technical Market Indicators. McGraw-Hill Professional, 2012.

M. C. R. Leles, M. V. L. Pereira, R. A. Iquiapaza, E. F. Sbruzzi, and C. L. N. Junior, “Evaluation of technical analysis trading rules in a artificial stock market environment,” IEEE Latin America Transactions, vol. 18, no. 10, pp. 1707–1714, 2020.

M. C. R. Leles, L. A. Mozelli, E. F. Sbruzzi, C. L. Nascimento Junior, and H. N. Guimaraes, “A multicriteria trading system based on singular spectrum analysis trading rules,” IEEE Systems Journal, 2019.

M. C. R. Leles, E. F. Sbruzzi, C. L. Nascimento Junior, and J. M. P. Oliveira, “Trading Switching Setup Based on Reinforcement Learning Applied to a Multiagent System

Simulation of Financial Markets,” in 2019 Annual IEEE International Systems Conference. IEEE, 2019, pp. 1–8.

M. C. R. Leles, L. A. Mozelli, C. L. Nascimento Junior, E. F. Sbruzzi, and H. N. Guimaraes, “Study on Singular Spectrum Analysis as a new technical oscillator for trading rules design,” Fluctuations and Noise Letters, vol. 17, no. 4, p. 1850034, 2018.

M. C. R. Leles, L. A. Mozelli, and H. N. Guimaraes, “New trend-following indicator: Using SSA to design trading rules,” Fluctuation and Noise Letters, vol. 16, no. 2, p. 1750016, 2017.

M. Amiri, M. Zandieh, B. Vahdani, R. Soltani, and V. Roshanaei, “An integrated eigenvector–dea–topsis methodology for portfolio risk evaluation in the forex spot market,” Expert systems with applications, vol. 37, no. 1, pp. 509–516, 2010.

M. Cerrato, N. Sarantis, and A. Saunders, “An investigation of customer order flow in the foreign Exchange market,” Journal of Banking & Finance, vol. 35, no. 8, pp. 1892–1906, 2011.

B. Kaczorowski, M. Kleina, M. M. Marques, and W. Silva, “Artificial intelligence and the multivariate approach in predictive analysis of the small cap index of the brazilian stock exchange,” IEEE Latin America Transactions, vol. 19, no. 11, pp. 1924–1932, 2021.

Z. Hu, Y. Zhao, and M. Khushi, “A survey of forex and stock price prediction using deep learning,” Applied System Innovation, vol. 4, no. 1, p. 9, 2021.

M. Fisichella and F. Garolla, “Can deep learning improve technical analysis of forex data to predict future price movements?” IEEE Access, vol. 9, pp. 153 083–153 101, 2021.

B. M. Henrique, V. A. Sobreiro, and H. Kimura, “Literature review: Machine learning techniques applied to financial market prediction,” Expert Systems with Applications, vol. 124, pp. 226–251, 2019.

M. Islam, E. Hossain, A. Rahman, M. S. Hossain, K. Andersson et al., “A review on recent advancements in forex currency prediction,” Algorithms, vol. 13, no. 8, p. 186, 2020.

K. Theofilatos, S. Likothanassis, and A. Karathanasopoulos, “Modeling and trading the eur/usd Exchange rate using machine learning techniques,” Engineering, Technology & Applied Science Research, vol. 2, no. 5, pp. 269–272, 2012.

G. E. Box, G. M. Jenkins, G. C. Reinsel, and G. M. Ljung, Time series analysis: forecasting and control. John Wiley & Sons, 2015.

F. Lemos, Analise Tecnica dos mercados financeiros: um guia completo e definitivo dos metodos de negociacao de ativos. Sao Paulo, Saraiva Educacao, 2015., 2015.

J. W. Goodell, S. Kumar, W. M. Lim, and D. Pattnaik, “Artificial intelligence and machine learning in finance: Identifying foundations, themes, and research clusters from bibliometric analysis,” Journal of Behavioral and Experimental Finance, vol. 32, p. 100577, 2021.

X. Man and E. P. Chan, “The best way to select features? comparing mda, lime, and shap,” The Journal of Financial Data Science, vol. 3, no. 1, pp. 127–139, 2021.

T. K. Ho, “Random decision forests,” in Proceedings of 3rd international conference on document analysis and recognition, vol. 1. IEEE, 1995, pp. 278–282.

L. Breiman, “Random forests,” Machine learning, vol. 45, no. 1, pp. 5–32, 2001.

C. L. Dunis, J. Laws, and G. Sermpinis, “Modelling and trading the eur/usd exchange rate at the ecb fixing,” The European Journal of Finance, vol. 16, no. 6, pp. 541–560, 2010.

W. F. Sharpe, “Mutual fund performance,” The Journal of business, vol. 39, no. 1, pp. 119–138, 1966.

T. W. Young, “Calmar ratio: A smoother tool,” Futures, vol. 20, no. 1, p. 40, 1991.

C.-W. Hsu, C.-C. Chang, C.-J. Lin et al., “A practical guide to support vector classification,” 2003.

A. V. Olivares-Nadal and V. DeMiguel, “Technical note—a robust perspective on transaction costs in portfolio optimization,” Operations Research, vol. 66, no. 3, pp. 733–739, 2018.